Navigating Your Financial Options

Equity release, a financial avenue allowing homeowners, typically those aged 55 and above, to access their property’s equity, presents an enticing opportunity for retirees to supplement income or finance significant expenses.

However, like any financial decision, equity release merits careful consideration of its advantages and drawbacks. As equity release gains traction in the UK, it’s imperative for individuals to grasp its potential benefits and pitfalls before committing.

- Pros and cons of equity release

Here’s an in-depth look at the pros and cons of equity release in the UK.

Advantages of Equity Release

Access to Tax-Free Cash

Equity release furnishes homeowners with tax-free lump sums or regular payments, offering a seamless means to bolster retirement income without tax liabilities.

Remain in the Property

he liberated equity can be allocated for diverse purposes, spanning home renovations, debt clearance, leisure pursuits, or aiding family members. This flexibility renders equity release an attractive option for numerous retirees.

Flexibility in Use of Funds:

The liberated equity can be allocated for diverse purposes, spanning home renovations, debt clearance, leisure pursuits, or aiding family members. This flexibility renders equity release an attractive option for numerous retirees.

- More Advantages to Equity Release

Many equity release plans incorporate a "no negative equity guarantee," assuring that repayment will never surpass the property's value. This shields homeowners and beneficiaries from residual debt if property value declines.

Certain equity release plans offer inheritance protection features, enabling homeowners to safeguard a segment of their property's value for beneficiaries, assuaging concerns about leaving a legacy.

Potential Downsides to Consider

Impact on Inheritance

By releasing property equity, homeowners diminish their estate value, potentially impacting the inheritance they pass on, necessitating careful consideration.

Potential Long-Term Cost

Over time, accrued interest on equity release loans may diminish the inheritance amount passed on, warranting careful assessment against immediate financial gains.

Effect on Means-Tested Benefits

Equity release might affect eligibility for means-tested benefits like pension credit or council tax reduction, necessitating a thorough understanding of potential entitlement impacts.

Complex Legal and Financial Implications

Equity release entails intricate legal and financial nuances. Seeking independent legal and financial advice is essential to comprehending equity release agreement implications, including early repayment charges and legal fees.

Embracing Informed Decision-Making

Equity release presents a gateway to financial freedom and flexibility for UK retirees. However, it’s essential to balance its merits against potential drawbacks, explore alternative avenues, and solicit guidance from qualified professionals before proceeding.

Armed with unbiased advice, individuals can navigate the equity release landscape with confidence, ensuring financial security and peace of mind in retirement.

Ready to explore equity release possibilities? Reach out to our team for expert guidance and support tailored to your needs.

- More resources

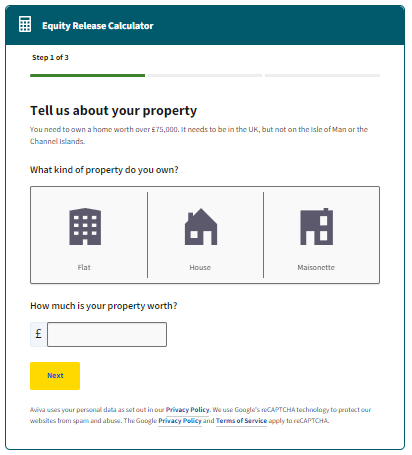

Get started

Schedule your personalised consultation today

We

are

better

together.

Drop your contact details into the form, and we’ll reach out to you!