Equity release has become a favored financial avenue among homeowners aged 55 or older, aiming to unlock their property’s value. As individuals delve into equity release, understanding associated interest rates becomes pivotal. This guide delves into equity release interest rates, offering insights and counsel to homeowners considering this financial path.

Understanding Equity Release Interest Rates

Equity release interest rates denote the borrowing cost associated with equity release schemes. These rates dictate the interest accruing on the loan, shaping the overall cost of the equity release arrangement over time. Homeowners must grasp how these rates are determined and the factors influencing them.

- Understanding Equity Release Interest Rates

Types of Interest Rates

Fixed Interest Rates

Fixed rates provide consistency throughout the loan term, offering predictability and stability in financial planning without fluctuating interest costs.

Variable Interest Rates

Variable rates fluctuate over time, often aligning with financial indices or benchmarks. While initially lower than fixed rates, variable rates introduce uncertainty as interest costs may vary during the loan period.

- Factors Influencing Equity Release Interest Rates

Older individuals often secure more favorable rates due to shorter loan repayment periods.

Property value directly impacts the releasable equity and may correlate with competitive interest rates, favoring higher property values.

Different plans may feature varied interest rate structures, necessitating a thorough assessment.

Broader economic climates and prevailing interest rate environments influence equity release interest rates, prompting homeowners to consider economic dynamics when evaluating options.

How to Secure Competitive Rates

Research and Compare

Conduct comprehensive research and compare offerings from diverse equity release providers to identify competitive interest rate options.

Consult a Specialist Adviser

Seek guidance from qualified equity release advisers to gain personalized insights and navigate interest rate complexities effectively.

Consider Professional Advice

Consult financial advisers well-versed in equity release to gain a nuanced understanding of available interest rate options, facilitating informed decision-making. We have Manchester equity release advisors, as well as other regions.

Understand the Impact of Rates

Delve into the long-term implications of interest rate structures on overall financial situations, vital for prudent decision-making.

While equity release offers financial flexibility and addresses diverse needs, responsible borrowing remains paramount. Understanding the implications of interest rates and their long-term financial impact underscores responsible financial decision-making.

Unlock the potential of equity release with informed consideration of interest rate dynamics, ensuring prudent financial stewardship and peace of mind.

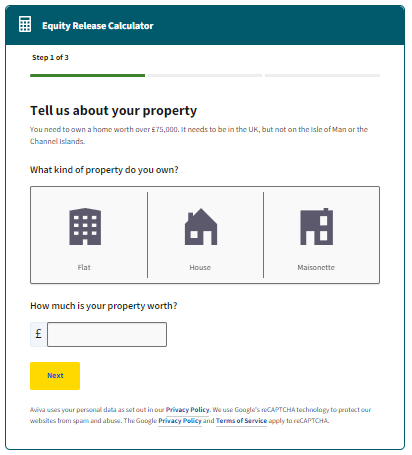

Ready to explore equity release possibilities? Consult our team for personalized guidance and support tailored to your needs.

Get started

Schedule your personalised consultation today

We

are

better

together.

Drop your contact details into the form, and we’ll reach out to you!