Understanding how equity release works is crucial for homeowners aged 55+, as it offers a pathway to financial freedom without the need to relinquish their beloved homes. As retirement strategies evolve, more individuals are turning to equity release to bolster their income, settle debts, undertake home renovations, or provide support to loved ones.

Understanding the Mechanisms

Delving into the fundamentals of equity release is pivotal to ascertain its compatibility with your financial objectives. Let’s delve into the core principles:

- Understanding Equity Release

Types of Equity Release

Lifetime Mortgages

This popular option empowers homeowners to access a portion of their property's value while retaining ownership. The amount available for release is influenced by factors such as property valuation and the homeowner's age.

Home Reversion Plans

Homeowners can opt to sell a portion or all of their property to an equity release provider in exchange for a lump sum or regular payments. The released equity is determined by the homeowner's age and the percentage of the property sold.

- Understanding Equity Release

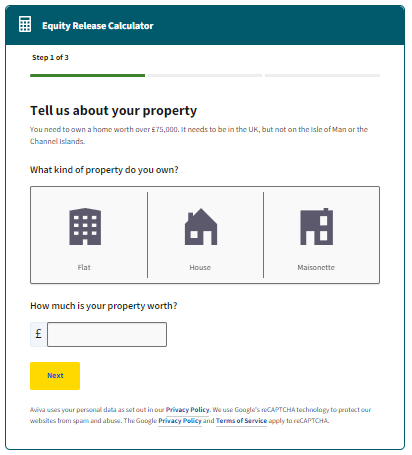

Eligibilty & Getting Started

Eligibility Criteria

Homeowners aged 55 or over, possessing a property of a certain value with minimal outstanding mortgage, are typically eligible for equity release.

Qualified Advisers

Seeking guidance from a qualified professional is imperative to gain a comprehensive understanding of the implications and commitments associated with equity release.

The process of Equity Release

Initial Consultation

Commence with an in-depth discussion with one of our qualified advisers to evaluate your financial situation and aspirations, determining the suitability of equity release for you.

Property Valuation

An independent surveyor assesses your property’s value, a critical step in determining the maximum release amount.. For example, those living in London, equity release payout will likely be more than Bristol equity release payments.

Product Recommendation

Based on your needs and property valuation, our adviser will recommend the most suitable equity release product tailored to your circumstances.

Application and Approval

Upon deciding to proceed, the application process begins. Lenders conduct thorough checks, and upon approval, the funds are disbursed.

Repayment

For lifetime mortgages, the loan and interest are typically repaid from the proceeds of the property’s sale after the homeowner’s passing or transition to long-term care.

With home reversion, the reversion company receives its share upon the property’s sale, with the remainder going to the homeowner or their beneficiaries.

- Crucial Considerations

Impact on Inheritance

Equity release may affect the value of your beneficiaries' inheritance. Discuss this aspect with your family to ensure alignment with your estate planning goals.

Evaluate the long-term financial implications thoroughly and explore alternative options before proceeding.

Specialist Advice

Seek guidance from one of our local advisers specializing in equity release to understand the risks and benefits comprehensively.

Equity release presents a valuable opportunity for homeowners aged 55 and above to tap into the equity tied up in their property. However, understanding the process, implications, and considerations is paramount. By arming yourself with comprehensive information, you can make informed decisions regarding your financial future.

As every individual’s situation is unique, expert advice is indispensable to ensure that equity release aligns with your specific needs and circumstances.

Ready to explore your options? Reach out to schedule a consultation with our experienced advisers.

Equity release can be a valuable financial tool to access funds tied up in your property. However, it’s important to consult with a professional adviser to ensure that it’s the right choice for your specific needs and circumstances

- More resources

Get started

Schedule your personalised consultation today

We

are

better

together.

Drop your contact details into the form, and we’ll reach out to you!