- Property Market & Equity Release in Bristol

If you are a homeowner in Bristol, equity release may be of interest. If you are aged over 55, with a property valued at £70,000 or more, you may be eligible for an equity release loan. All our advisers are authorised and regulated by the Financial Conduct Authority, ensuring you can verify their credentials in the Financial Services Register.

You’ll be pleased to know that all funds acquired through equity release are tax-free, and you can choose to receive your equity loan either as a one-off lump sum or in regular payments.

Our dedicated equity release adviser in Bristol will provide you with a detailed explanation of the options available, which can vary based on the equity release provider you choose and the specific plan you opt for.

How Can Preferred Equity Release Be Of Service?

Benefit from our complimentary initial consultation, offering significant value to those considering equity release in Bristol.

To speak to a local Bristol adviser call tel: 0117 409 009

Bristol, the bustling city in the Southwest of England, boasts a dynamic property market with a diverse array of housing options and a storied past. In this article, we’ll take a closer look at the property market in Bristol, highlighting its average property prices, recent transactions, and key property types.

We’ll also delve into the concept of equity release and its significance within Bristol’s vibrant property scene, as well as consider the surrounding areas that enhance Bristol’s distinct charm.

Bristol: A Glimpse into Recent Property Transactions

Over the past year, properties in Bristol have seen an overall average price of £386,006, signifying the city’s importance as a major hub for real estate. A remarkable number of properties, 4,619 to be exact, were sold, indicating a robust and active market. Among the most significant sales was a property in Rodney Place, Bristol, City Of Bristol BS8 4HY, which fetched a staggering £2,950,000 in May 2023.

Prominent Property Types in Bristol

When examining the types of properties sold, terraced houses were the most sought after, achieving an average price of £380,812. Flats were also in demand, with an average selling price of £276,036, while semi-detached homes realized an average price of £412,112, all contributing to the eclectic mix that defines Bristol’s property market.

Bristol property sales 2023

homes changed hands

average sale price

most expensive home sold

Bishopston

Known for its vibrant community and amenities, the Bishopston property market offers a mix of period homes and contemporary residences. The average property price in Bishopston is around £422,000, attracting buyers seeking a desirable location with a range of housing options.

Kingswood

This suburb of Bristol has a mix of residential areas and green spaces, with the property market providing a range of housing styles from modern developments to period properties. The average property price in Kingswood is approximately **£250,000**, making it an attractive location for buyers looking for affordable homes within easy reach of Bristol city center.

Redlands

This affluent suburb of Bristol is known for its Victorian and Edwardian architecture, andt features a mix of elegant period homes and stylish apartments. The average property price in Redland is around **£480,000**, appealing to buyers looking for upscale properties in a desirable residential area close to the city center.

Henleaze

Henleaze, is a popular residential area, known for its leafy streets and family-friendly environment, offering a mix of spacious period homes and modern developments. The average property price in Henleaze is approximately **£400,000**, making it an attractive choice for buyers seeking a well-established neighborhood with good schools and amenities.

Clifton

Offering a diverse property market with a range of housing options including detached family homes, apartments, and townhouses, with an average price of £300,000, making it an attractive location. With its proximity to Bristol’s amenities, good schools, and green spaces, Clinton presents a sought-after real estate market for those seeking a mix of urban convenience and suburban tranquility

Abbots Leigh

Abbots Leigh is a charming village with a vibrant property market offering a variety of housing options including period homes, cottages, and contemporary residences, with an average price of £600,000, showcasing the high demand . Boasting close proximity to Bristol, top-rated schools, and picturesque countryside walks, Abbots Leigh presents an alluring option.

Keynsham

Located between Bristol and Bath, this area offers a diverse property market with a mix of historic buildings, modern developments, and family homes, with an average coast of £300,000 making it an attractive option for buyers looking for more affordable housing within commuting distance of major cities. Keynsham is popular with individuals seeking a balance between urban convenience and suburban tranquility.

Sneyd Park

Sneyd Park is known for its luxury homes and stunning views of the Avon Gorge, and features a range of prestigious properties including spacious mansions and contemporary apartments. The average property price in Sneyd Park is around £800,000, appealing to affluent buyers looking for high-end real estate in a picturesque setting close to the Clifton Suspension Bridge.

Stoke Bishop

This sought-after suburb is known for its elegant Victorian and Edwardian properties, offering a mix of spacious family homes and upscale apartments. The average property price in Stoke Bishop is approximately £550,000, making it an attractive choice for those seeking a desirable residential area with good schools and convenient access to local amenities.

Bedminster

Bedminster is known for its community spirit and artistic vibe, with offers a diverse mix of Victorian terraces, modern apartments, and new developments. The average property price in Bedminster is around £280,000 making it a more affordable option for first-time buyers and young professionals looking to live in a lively neighborhood with easy access to the city center

Bristol Equity Release and Surroundings

The concept of equity release is becoming increasingly popular in Bristol and its surrounding areas, providing homeowners with the chance to tap into the equity of their homes. With the thriving property markets in Bristol, Bath, and Gloucester, residents can leverage equity release to access funds for a variety of needs, such as renovations, planning for retirement, or assisting family members financially.

The key points to note are that the property markets in Bristol, Bath, and Gloucester offer vibrant and varied opportunities for both purchasers and vendors. Each location has its own distinct charm and advantages, and with equity release, homeowners have more financial options at their disposal. The region around Bristol remains a desirable area for property dealings.

For anyone interested in buying, selling, or considering equity release, Bristol and its neighboring cities provide a plethora of possibilities within the property sector.

We provide impartial advice, connecting you with a certified professional who has your best interests at heart. We pride ourself on our ethics and customer centric focus

More resources

How does equity release work?

We understand it can be daunting researching important financial decisions, so we let us help

Equity release interest rates

Rates can vary by lender, product type, and borrower . Always research

How much equity can I release?

Property value, your age & health, are all factors, so speaking to a qualified adviser is needed

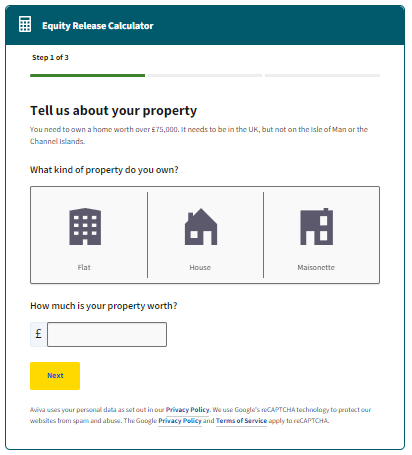

Equity release calculator

Understand how much you could potentially release, compare products and lenders.

Do I qualify for equity release?

While most can, there are some factors that disqualify some from certain release schemes

Pros & cons of equity release

While a sound choice for most, learn if it's right for you and your specific circumstances and goals

Lifetime mortgage

Lifetime mortgages & home reversion schemes are 2 types of equity release. Learn which one fits you.

Getting started

Our team of licensed advisers with decades of experience, ready to help with impartial advice

Please reach out with any questions and speak to a licensed adviser

Speak to a local expert

Drop your contact details into the form, and we’ll reach out to you!