- Property Market & Equity Release in Brighton

If you are over 55 years old, and a homeowner in Brighton, equity release could be worth researching. If your property is valued over £70.000, you may be eligible for an equity release loan. All our advisers are regulated by the Financial Conduct Authority and you can find each one in the Financial Services Register.

All equity release funds are tax free and you will receive an equity loan in the form of a lump sum or regular instalments.

Our local equity release adviser will discuss the available options in more detail as these vary depending on the equity release lender you select and the specific equity release plan you decide on.

How Can Preferred Equity Release Help?

We provide a free initial consultation that is hugely beneficial for anyone considering equity release in Brighton.

Access help and advice today across Brighton and the south coast.

The vibrant city of Brighton has been a focal point for property investment and homeownership, characterized by its diverse housing options and bustling real estate market. In this article, we’ll delve into the property market in Brighton, shedding light on its average property prices, recent transactions, and distinctive property types. Additionally, we’ll explore the concept of equity release and its relevance in this dynamic property landscape, along with insights into the neighboring areas that complement Brighton’s unique appeal.

Brighton: A Snapshot of Property Transactions

Properties in Brighton had an overall average price of £509,680 over the last year, reflecting the city’s status as a prominent real estate hub. Notably, 1,321 properties changed hands, underscoring the active nature of the property market. One of the most significant transactions took place in Courtenay Terrace, Hove, Brighton And Hove BN3 2WF, where a property was sold for an impressive £7,500,000 in April 2023.

Diverse Property Types

Breaking down the types of properties sold, flats emerged as the popular choice, commanding an average price of £358,390. Terraced properties also garnered attention, selling for an average of £617,539, while semi-detached properties fetched £583,393 on average. This diversity in property types reflects the varied preferences of buyers and the rich assortment of housing options available in Brighton.

Brighton property sales 2023

homes changed hands

average sale price

most expensive home sold

Southwick

Southwick has seen a strong demand for semi-detached properties, with an average selling price of £435,342. Additionally, terraced properties have also been popular, with a vibrant market offering a variety of options for buyers and

Shoreham-by-Sea

The property market in Shoreham-by-Sea has shown resilience with an overall average price of £450,054 over the last year. Despite a slight decrease in asking prices by 2.1%, house prices in Shoreham-by-Sea are still 9.8% higher than a year ago.

Littlehampton

The property market in Littlehampton, has shown an overall average price of £393,970 over the last year. With a majority of sales in Littlehampton, properties spend an average of 17 weeks on the market.

Eastbourne

Embracing the allure of coastal living, Eastbourne has carved its place as an attractive destination for property seekers. The average property price in Eastbourne reflects the blend of seaside tranquility and a range of housing choices, making it an appealing location for those seeking a relaxed yet vibrant lifestyle.

Bognor Regis & Chichester

Bognor Regis and Chichester offer distinctive property landscapes, enriched by their coastal settings and historical significance. The average property prices in these areas mirror the appeal of coastal retreats and the timeless charm of historic properties, catering to a diverse range of buyer preferences.

Equity Release: Leveraging Property Assets

In the context of Brighton and its neighboring areas, the concept of equity release holds relevance for homeowners looking to leverage the value locked in their properties. With the buoyant property markets and diverse housing options in these locations, homeowners may explore equity release as a means of accessing funds for various purposes, such as home improvements, retirement planning, or supporting family members.

Key takeaways: these property markets present a tapestry of opportunities for property investment and homeownership. With unique characteristics, diverse housing options, and distinctive regional appeals, these areas continue to attract interest from buyers and investors. Whether you’re considering buying, selling, or exploring equity release options, Brighton and its neighboring neighborhoods offer a wealth of possibilities in the property market.

We provide impartial advice, connecting you with a certified professional who has your best interests at heart. We pride ourself on our ethics and customer centric focus

How does equity release work?

We understand it can be daunting researching important financial decisions, so we let us help

Equity release interest rates

Rates can vary by lender, product type, and borrower . Always research

How much equity can I release?

Property value, your age & health, are all factors, so speaking to a qualified adviser is needed

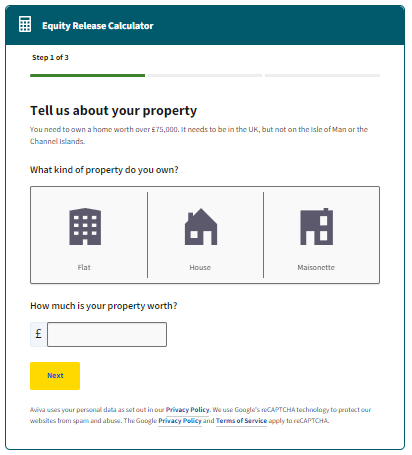

Equity release calculator

Understand how much you could potentially release, compare products and lenders.

Do I qualify for equity release?

While most can, there are some factors that disqualify some from certain release schemes

Pros & cons of equity release

While a sound choice for most, learn if it's right for you and your specific circumstances and goals

Lifetime mortgage

Lifetime mortgages & home reversion schemes are 2 types of equity release. Learn which one fits you.

Getting started

Our team of licensed advisers with decades of experience, ready to help with impartial advice

Please reach out with any questions and speak to a licensed adviser

UK Property Markets

- Speak to a certified expert near you