Navigating Equity Release Eligibility

Equity release offers UK homeowners a pathway to unlock the value of their property. However, understanding eligibility criteria is key, shaping who can benefit from this financial opportunity. This guide provides insights into the factors influencing equity release eligibility, empowering homeowners in their financial decisions.

Deciphering Equity Release Eligibility

Qualifying for equity release involves meeting specific criteria tailored to individual circumstances and informed financial choices.

- Understanding Equity Release Elgibility Requirements

Key Criteria for Equity Release Qualification

Age

Equity release products are typically available to individuals aged 55 and above, making age a fundamental factor in eligibility.

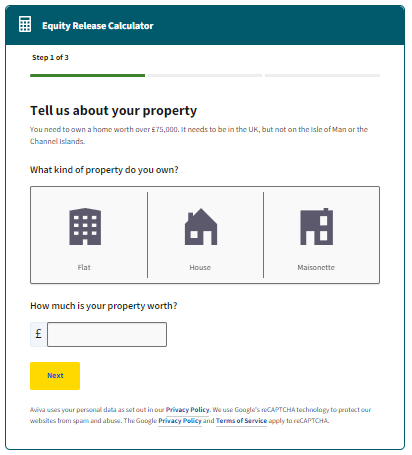

Property Ownership & Value

Homeowners must own a UK property with minimal or no mortgage, meeting minimum value thresholds, typically starting at £70,000.

Property type

While most residential properties qualify, non-standard constructions may undergo additional scrutiny.

- Exploring Additional Considerations

Health Considerations

Certain medical conditions or lifestyle factors may lead to enhanced terms, such as a higher loan-to-value ratio. Factors include smoking status, BMI, and specific pre-existing medical conditions.

Financial Criteria

While traditional mortgage affordability assessments are not primary, homeowners are required to meet certain financial criteria. Seeking financial advice is recommended to assess the long-term impact on finances.

How to Determine Eligibility for Equity Release

Consulting with a Specialist Adviser

eek guidance from qualified equity release advisers for clarity on eligibility and available options.

Understanding Property Valuation

Current property valuation determines compliance with minimum value requisites for equity release.

Considering Health Factors

Explore products offering enhanced terms based on health considerations for individuals with specific health profiles.

Financial Consultation

Engage financial advisers for a comprehensive grasp of equity release’s financial implications.

Equity release demands a responsible approach, aligning with long-term financial goals. Responsible borrowing and informed decision-making should guide the equity release journey.

Key Takeaways:

Equity release eligibility intertwines age, property value, health, and financial assessments. With our professional advice, gain clarity on eligibility and make informed financial strides. Carefully assess your circumstances to understand implications before proceeding.

Unlock the potential of your property responsibly with equity release. Speak to one of our local advisers today.

- More resources

Get started

Schedule your personalised consultation today

We

are

better

together.

Drop your contact details into the form, and we’ll reach out to you!