In the realm of UK homeownership, equity release has become increasingly popular as a means of unlocking property value. The question of how much equity can I release, is now a common inquiry among homeowners.

Dive into this guide to uncover the factors influencing equity release amounts and gain valuable insights into this financial solution.

Understanding Equity Release

Equity release empowers homeowners to tap into the wealth stored within their properties without the need to sell or relocate. This serves as a valuable resource for retirees or those nearing retirement, facilitating income supplementation, home improvements, or financial support.

Factors Influencing Release Amounts

Age of the Homeowner

Age is a pivotal factor in equity release calculations. Older homeowners typically access a higher percentage of their property's value.

Property value

The current market value of the property is a primary determinant of the release amount. Generally, higher property values correlate with greater potential equity release.

Some equity release products consider homeowners' health and lifestyle. Specific conditions or factors may grant access to enhanced equity release options.

Type of Equity Release Plan

The chosen equity release product impacts the release amount. Options like lifetime mortgages or home reversion plans offer varying percentages and terms.

- Understanding Equity Release

Main Types of Equity Release

Lifetime Mortgage

This is the most common type of equity release product. Homeowners can release a portion of their property's value while retaining ownership. The amount depends on the property value, homeowner's age, and specific terms.

Home Reversion Plans

Homeowners sell a portion or all of their property to an equity release provider in exchange for a lump sum or regular payments. The amount released is influenced by the homeowner's age and the percentage of the property sold.

Equity Release Process

Initial Consultation

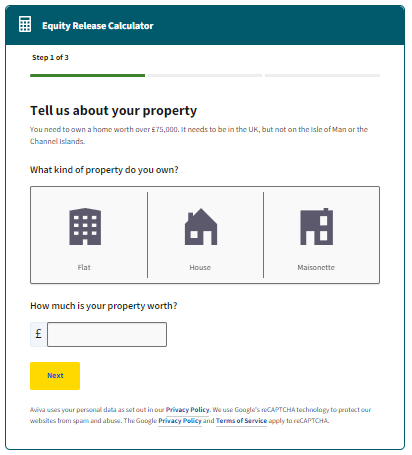

Our local advisers gather financial insights, goals, and circumstances to assess equity release suitability.

Property Valuation

Independent surveyors evaluate property value, crucial in determining the maximum release amount.

Product Recommendation

Our qualified experts provide tailored equity release recommendations aligned with your needs and property valuation.

Application and Approval

The application process commences upon your decision to proceed, with lenders conducting thorough checks and funds released upon approval.

Repayment

Lifetime mortgages entail repayment from property sale post-homeowner’s passing or move to care. Home reversion involves property sale, with proceeds split between the homeowner and the reversion company.

- Key Considerations

Equity release can reduce the value of the inheritance that your beneficiaries receive. Consider the implications on your estate and discuss this with your family.

Consider the long-term financial implications and explore alternative options before proceeding with equity release.

Speak to an adviser specializing in equity release to ensure you are fully informed of the potential risks and benefits.

Responsible Equity Release Planning

Providers utilize actuarial calculations, factoring property value, homeowner age, and additional variables to determine release amounts.

Consult with one of our qualified specialists for tailored insights into potential equity release amounts based on your individual circumstances.

Unlock your property’s potential responsibly through research and professional consultation.

- More resources

Get started

Schedule your personalized consultation today

We

are

better

together.

Drop your contact details into the form, and we’ll reach out to you!