- local expertise

Property Market & Equity Release in Manchester

If you’re a homeowner in Manchester, over 55, and your property is valued at a minimum of £70,000, you might qualify for an equity release loan. Our advisers are all regulated by the Financial Conduct Authority, and you can verify their credentials in the Financial Services Register.

The funds from equity release are tax-free, and you can opt to receive your equity loan as either a lump sum or in regular payments.

Our Manchester-based equity release adviser will provide a detailed discussion of the options available to you, as these can vary based on the equity release lender you choose and the specific plan you go for.

How Can Preferred Equity Release Assist You?

We offer a complimentary initial consultation that is extremely advantageous for anyone contemplating equity release in Manchester.

Gain access to support and guidance today throughout Manchester and its surrounding areas, and call 0161 394 0856 today

Nestled in the heart of the North West of England, Manchester stands as a vibrant property hub, offering a diverse range of housing options and investment opportunities. In this article, we’ll delve into the dynamic property landscape of Manchester, exploring its average property prices, recent transactions, and prominent property types. Additionally, we’ll shed light on the concept of equity release and its relevance in this bustling property market, along with insights into the neighboring areas of Altrincham, Wilmslow, Macclesfield, Stockport, Salford, Cheadle, Alderley Edge, and Knutsford, each contributing to Manchester’s distinctive residential appeal.

Manchester: A Snapshot of Property Transactions

Properties in Manchester commanded an overall average price of £293,474 over the last year, underlining the city’s significance as a thriving real estate hub. Notably, 7,291 properties changed hands, reflecting the active nature of the property market. One of the most notable transactions took place in Brooks Drive, Hale Barns, Altrincham, Greater Manchester WA15 8TN, where a property was sold for a substantial £2,570,000 in July 2023.

Prominent Property Types

Breaking down the types of properties sold, semi-detached properties emerged as the popular choice, commanding an average price of £324,937. Terraced properties also garnered attention, selling for an average of £241,592, while flats fetched £193,715 on average. This diverse range of property types reflects the varied preferences of buyers and the rich assortment of housing options available in Manchester.

Manchester property sales 2023

homes changed hands

average sale price

most expensive home sold

Cheadle

The property market in Cheadle is currently vibrant, with a diverse range of homes for sale, from charming semi-detached houses to spacious family homes, catering to various preferences and budgets With properties selling at a steady pace, Cheadle offers a promising opportunity for potential homeowners and investors

Alderley Edge

Alderley Edge boasts a prestigious property market, featuring a variety of luxurious homes, from modern apartments to grand detached houses, often commanding high prices. The area is known for its exclusive feel and picturesque setting, making it a sought-after location for discerning buyers

Knutsford

The property market in Knutsford is characterized by a diverse range of listings, from charming countryside cottages to spacious family homes, with prices ranging from £100,000 to £2,000,000. The area is known for its attractive rural settings and proximity to Manchester, making it a desirable location for various buyers

Altrincham

Altrincham’s property market is thriving, offering a wide range of properties for sale, from affordable apartments to luxurious family homes, with prices generally ranging between £100,000 and £800,000. The area is known for its vibrant community, excellent schools, and convenient transport links, making it an attractive location for families and professionals alike

Stockport and Salford

Stockport and Salford embody urban connectivity and residential appeal, offering a seamless blend of urban amenities and residential tranquility. The average property prices in these areas signify the allure of city living and the availability of diverse residential choices, making them sought-after locations for property seekers.

Wilmslow, & Macclesfield

Macclesfield offer a blend of suburban charm and residential diversity, characterized by their picturesque surroundings and diverse housing stock. The average property prices in these areas reflect the enduring appeal of suburban living and the potential for investment and growth, catering to a broad spectrum of buyer preferences.

Equity Release: Unlocking Property Potential

In summary, the property markets in Manchester, and surroundings offer a tapestry of opportunities for property investment and homeownership. With unique characteristics, diverse housing options, and distinctive regional appeals, these areas continue to attract interest from buyers and investors. Whether you’re considering buying, selling, or exploring equity release options, Manchester and its neighboring neighborhoods present a wealth of possibilities in the property market.

We provide impartial advice, connecting you with a certified professional who has your best interests at heart. We pride ourself on our ethics and customer centric focus

More resources

How does equity release work?

We understand it can be daunting researching important financial decisions, so we let us help

Equity release interest rates

Rates can vary by lender, product type, and borrower . Always research

How much equity can I release?

Property value, your age & health, are all factors, so speaking to a qualified adviser is needed

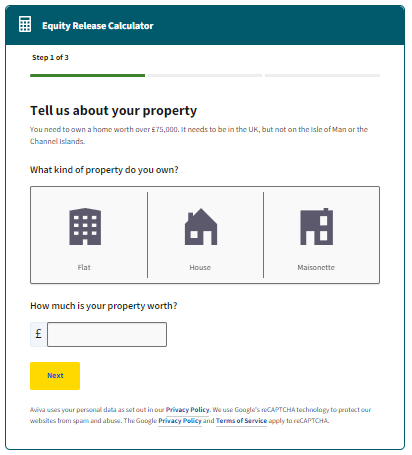

Equity release calculator

Understand how much you could potentially release, compare products and lenders.

Do I qualify for equity release?

While most can, there are some factors that disqualify some from certain release schemes

Pros & cons of equity release

While a sound choice for most, learn if it's right for you and your specific circumstances and goals

Lifetime mortgage

Lifetime mortgages & home reversion schemes are 2 types of equity release. Learn which one fits you.

Getting started

Our team of licensed advisers with decades of experience, ready to help with impartial advice

Please reach out with any questions and speak to a licensed adviser

Speak to a local expert

We

are

here

to help

Drop your contact details into the form, and we’ll reach out to you!