- local expertise

Property Market & Equity Release in London

If you are over 55 years of age, your property is valued at least £70,000, a Londonequity release loans could be a way to access value in your home without needing to sell. Our advisers are fully regulated by the Financial Conduct Authority, providing you with reliable and professional guidance.

The funds from equity release are completely tax-free, and you have the flexibility to receive your equity loan as a one-time lump sum or in regular installments.

Our local equity release advisors in London will help you navigate the diverse options available, which can differ based on the equity release lender you select and the particular equity release plan you opt for.

How Can Preferred Equity Release Be Of Service in London?

We provide a complimentary initial consultation that is extremely advantageous for those contemplating equity release in London.

Receive expert assistance and advice in London, and take the first step towards a financially secure future.

If you would like to speak to a local adivser, please call London 0203 769 3171

The city of London, standing at the forefront of global finance and culture, boasts a dynamic property market with a diverse array of housing options and a storied past. This article will dive into the property market in London, highlighting its average property prices, recent transactions, and key property types. We will also examine the role of equity release within this bustling property scene and provide insights into the surrounding areas that enhance London’s distinctive charm.

London: A Snapshot of Property Transactions

Over the past year, properties in London have seen an overall average price of £709,618, signifying the city’s prominence as a major real estate hub. The market has been particularly active, with 56.5k property sales, demonstrating a robust turnover.

Prominent Property Types

In terms of property types, flats were the most commonly sold, averaging £547,510 , while terraced properties sold for an average of £794,764, and semi-detached homes commanded £766,820 on average. These figures underscore the variety and vitality of London’s property market.

Equity Release in London

Equity release has become an increasingly relevant option for homeowners in London, particularly for those aged 55 and above with properties valued at a minimum of £70,000. This financial solution allows residents to tap into the value of their homes, providing them with additional funds to enjoy their retirement years or to meet other financial needs.

London property sales 2023

homes changed hands

average sale price

most expensive home sold

Chelsea

This affluent area in West London, boasts a prime property market known for its elegant Georgian and Victorian houses, luxurious apartments, and prestigious garden squares. The average property price in Chelsea is notably high, around £1.5 million, attracting affluent buyers seeking upscale living, exclusive boutiques, fine dining, and proximity to the iconic King’s Road.

Richmond

This picturesque suburb offers a diverse property market with a mix of period homes, riverside properties along the Thames, and modern apartments. The average property price in Richmond is approximately £900,000 reflecting its desirability due to its green spaces, historic charm, excellent schools, and easy access to central London.

Croydon

This dynamic property market has a range of housing options including new developments, Victorian houses, and modern apartments. The average property price in Croydon is around £350,000 making it an attractive choice for first-time buyers, investors, and families looking for more affordable housing within easy reach of central London.

Sevenoaks

Sevenoaks boasts a diverse property market featuring historic homes, country estates, and modern developments. The average property price in Sevenoaks is approximately £700,000, reflecting its appeal to those seeking a mix of countryside living, good schools, and convenient access to London.

Kingston -upon-Thames

Kingston Upon Thames, a picturesque riverside town in Greater London, features a diverse property market with a blend of period homes, modern apartments, and riverside properties. The average property price in Kingston Upon Thames is approximately £600,000, attracting buyers looking for a mix of historic charm, good amenities, and proximity to the River Thames.

Weybridge

Weybridge offers a prestigious property market with a mix of luxurious homes, riverside properties, and exclusive estates. The average property price in Weybridge is around £1.2 million making it a sought-after location for affluent buyers looking for upscale living in a well-connected area close to London.

Battersea

A thriving property market characterised by a mix of Victorian terraces, modern riverside apartments, and luxury developments like Battersea Power Station. The average property price in Battersea is around £700,000 reflecting the area’s appeal due to its excellent transport links, green spaces, and vibrant dining.

Wandsworth

Wandsworth, located in South West London, boasts a vibrant property market with a mix of period homes, modern apartments, and riverside properties along the Thames. The average property price in Wandsworth is around £750,000, reflecting the desirability of the area due to its excellent schools, green spaces, and proximity to central London.

Wimbledon

Wimbledon, known for its prestigious tennis championship, offers a diverse property market with a range of period homes, modern apartments, and charming terraced houses. The average property price in Wimbledon is approximately £800,000, attracting buyers looking for a mix of suburban tranquility and urban convenience in South West London.

Equity Release in London

The concept of equity release is becoming increasingly popular in London, providing homeowners with the chance to access the value built up in their homes. Given the thriving property market in London, homeowners are well-positioned to explore equity release as a viable option for generating funds for a variety of needs, including home renovations, retirement planning, or offering financial support to family members.

Key Insights:

The property market in London offers a dynamic environment with abundant opportunities for both purchasers and sellers. With each borough boasting its unique charm, and equity release adding another layer of financial flexibility for homeowners, London stands out as a prime location for property investment.

For those interested in buying, selling, or considering equity release, London’s property market presents a multitude of possibilities, making it an exciting and strategic choice for property-related endeavors.

We provide impartial advice, connecting you with a certified professional who has your best interests at heart. We pride ourself on our ethics and customer centric focus

More resources

How does equity release work?

We understand it can be daunting researching important financial decisions, so we let us help

Equity release interest rates

Rates can vary by lender, product type, and borrower . Always research

How much equity can I release?

Property value, your age & health, are all factors, so speaking to a qualified adviser is needed

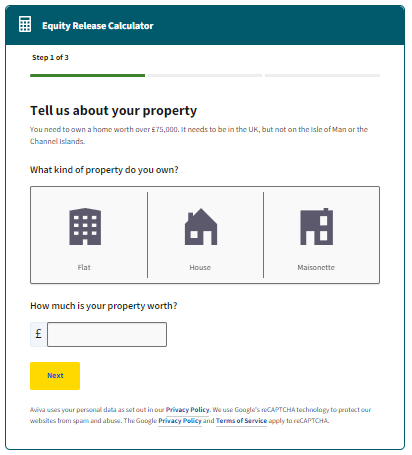

Equity release calculator

Understand how much you could potentially release, compare products and lenders.

Do I qualify for equity release?

While most can, there are some factors that disqualify some from certain release schemes

Pros & cons of equity release

While a sound choice for most, learn if it's right for you and your specific circumstances and goals

Lifetime mortgage

Lifetime mortgages & home reversion schemes are 2 types of equity release. Learn which one fits you.

Getting started

Our team of licensed advisers with decades of experience, ready to help with impartial advice

Please reach out with any questions and speak to a licensed adviser

Speak to a local expert

Schedule your personalised consultation today

We

are

here

to help

Drop your contact details into the form, and we’ll reach out to you!