- local expertise

Property Market & Equity Release in Devon

If you are a homeowner in Exeter, over 55 years old and your property is worth at least £70,000, you could be eligible for an equity release loan. All our advisers are regulated by the Financial Conduct Authority and you can find each one in the Financial Services Register.

All equity release funds are tax free and you will receive an equity loan in the form of a lump sum or regular instalments.

Our local equity release adviser will discuss the available options in more detail as these vary depending on the equity release lender you select and the specific equity release plan you decide on.

How Can Preferred Equity Release Help?

We provide a free initial consultation that is hugely beneficial for anyone considering equity release in Exeter.

Access help and advice today across Exeter, Torquay and Plymouth.

When it comes to the property market & equity release, Exeter, Torquay, and Plymouthhave witnessed significant activity, presenting unique opportunities for both buyers and sellers. We’ll delve into the specifics of the property market, and explore the concept of equity releasein these vibrant locations.

Exeter – a closer look

Exeter‘s property market has shown resilience and growth, with an overall average price of £341,568 over the last year. This is indicative of a healthy and competitive market, with 920 properties changing hands. Notably, the most expensive property sale was recorded in Monmouth Street, Topsham, Exeter, DevonEX3 0AJ, fetching an impressive £2,000,000 in March 2023.

Breaking down the types of properties sold, terraced properties were the most popular, commanding an average price of £309,849. Semi-detached properties followed closely at an average of £382,488, while flats remained an attractive option for many, fetching an average of £204,086.

Exeter property sales 2023

homes changed hands

homes changed hands

most expensive home sold

council tax bands

St. Leonard's

Known for its charming character and sought-after properties, St. Leonard’shas been a hotspot for buyers looking for a blend of historic and modern living. The average property price in this area has shown stability and promise, making it an attractive choice for those seeking a vibrant community and convenient amenities.

Heavitree

With its close proximity to the city center and excellent transport links, Heavitreehas continued to draw interest from both buyers and investors. The average property price reflects the desirability of this area, with a range of housing options to suit different preferences and budgets.

Birchy Barton

A burgeoning neighborhood with a mix of new developments and established homes, Birchy Bartonoffers a diverse range of properties catering to various lifestyles. The property market in this area has seen steady growth, making it an area to watch for potential buyers and sellers alike.

Exmouth & Exminster

Neighbouring Exeter these areas have showcased their appeal through a combination of coastal beauty and convenient access to amenities. The property market in both Exmouth and Exminster has demonstrated resilience, with a range of property types available to cater to different needs.

Torquay

Torquay‘s property market has been characterised by a diverse range of housing options, with an overall average price of £298,534 over the last year. The area has seen 730 properties sold, indicating steady activity and interest from buyers. Notably, the most sought-after properties in Torquay have included spacious family homes with scenic views and convenient access to amenities.

Plymouth

Plymouth’s property market has demonstrated strength and resilience, with an overall average price of £228,312 over the last year. The city has seen 1,430 properties changing hands, reflecting a dynamic and bustling market. Notably, the waterfront properties in areas such as The Hoe and Barbican have attracted significant attention, showcasing the appeal of coastal living in Plymouth.

Equity Release in the South West

The concept of equity releasehas gained traction in the South West, offering homeowners in Exeter, Torquay, and Plymouththe opportunity to unlock the value tied up in their properties. With the buoyant property markets in these cities, homeowners may find themselves well-placed to consider equity releaseas a means of accessing funds for various purposes, such as home improvements, retirement planning, or supporting family members.

Key takeaways are that the property markets in Exeter, Torquay, and Plymouthpresent dynamic landscapes with opportunities for both buyers and sellers. With specific areas offering their own unique appeal, and the concept of equity releaseproviding additional options for homeowners, the South Westcontinues to be an attractive destination for property investment.

Whether you’re a prospective buyer, seller, or homeowner considering equity release, the areas of Exeter, Torquay, and Plymouthoffer a wealth of opportunities in the property market.

We provide impartial advice, connecting you with a certified professional who has your best interests at heart. We pride ourself on our ethics and customer centric focus

More resources

How does equity release work?

We understand it can be daunting researching important financial decisions, so we let us help

Equity release interest rates

Rates can vary by lender, product type, and borrower . Always research

How much equity can I release?

Property value, your age & health, are all factors, so speaking to a qualified adviser is needed

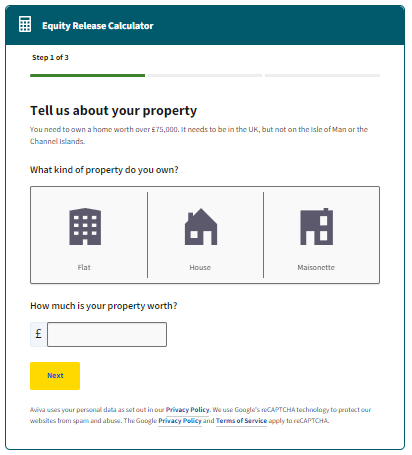

Equity release calculator

Understand how much you could potentially release, compare products and lenders.

Do I qualify for equity release?

While most can, there are some factors that disqualify some from certain release schemes

Pros & cons of equity release

While a sound choice for most, learn if it's right for you and your specific circumstances and goals

Lifetime mortgage

Lifetime mortgages & home reversion schemes are 2 types of equity release. Learn which one fits you.

Getting started

Our team of licensed advisers with decades of experience, ready to help with impartial advice

Please reach out with any questions and speak to a licensed adviser

Speak to a local expert

Drop your contact details into the form, and we’ll reach out to you!